Unsocial hours payments or enhancements are paid if you are required to work to cover services in the evening, at night, over weekends and on general public holidays.

Unsocial hours payments are additions to basic pay and are calculated as a proportion of basic pay (including long-term recruitment and retention premiums (RRPs), but excluding short-term RRPs, high cost area supplements, and all other supplements and payments). The exact rate of payment depends on when the unsocial hours were worked and on your pay band. Please see Section 2 of the NHS Terms and Conditions of Service Handbook

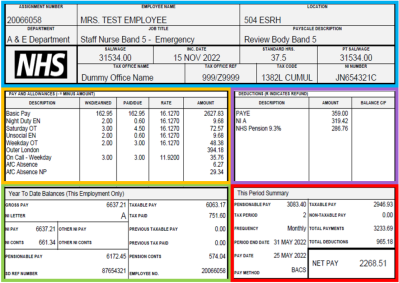

An example is provided below of how enhancements would appear on the payslip of someone who, for the purposes of this example, is band 5 with a basic hourly rate of £16.84. If they who worked 10 hours on Saturday and 1 hour on Sunday, the enhancement for their Saturday unsocial hours would be paid as 30% of their basic pay for the same hours and the enhancement for their Sunday unsocial hours as 60% (based on 22/23 rates). The unsocial hours payments would be shown on their payslip as follows:

| Description |

WKD/EARNED |

PAID/DUE |

RATE |

AMOUNT |

| Saturday EN |

10 |

3.00 |

16.84 |

50.52 |

| Sunday EN |

1 |

0.6 |

16.84 |

10.10 |

Unsocial hours are paid a month in arrears based on the timesheet details recorded by your manager on Healthroster.

If you have checked your payslip carefully and think you haven't been paid for the correct number of unsocial hours, please review your Healthroster record to check that your manager recorded your shift times correctly before the payroll cut-off date (this is the third working day of the month following that in which the hours were worked).

If your pay is incorrect because due to what has been recorded on the roster, please speak to your manager and ask them to submit a Data Amendment Form (DAF). Once the necessary corrections have been made, any pay adjustments required will be applied in the next available payroll run.

For any further assistance required on using Healthroster, please contact the Healthroster team.